When Buyers Walk

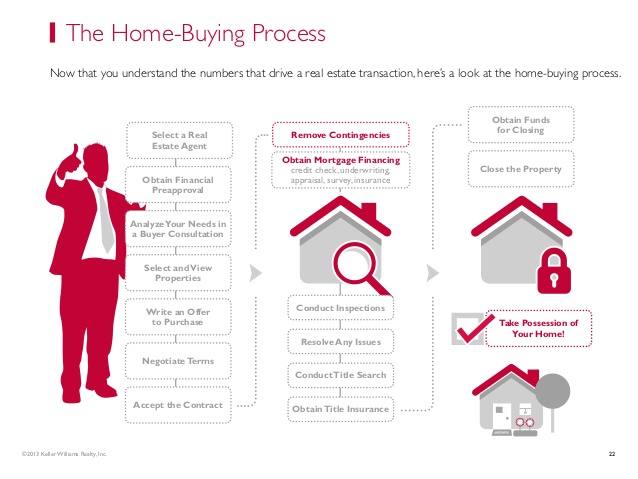

So, you’re having trouble getting buyers to stick it out with you? They meet with you, discuss their needs, see a few homes, and then decide to either delay their purchase – or switch agents. Sound familiar? Yikes! It can be frustrating and demoralizing to lose potential buyers time and time again, especially when you don’t know why. The homebuying journey can be an emotional ride for buyers and agents alike. Even qualified buyers approved for a mortgage face many hurdles in their search for the right neighborhood and property. A mistake at any point during the process can cost thousands of dollars and countless sleepless nights. That’s why the home buyer consultation is such a critical step.

The Typical Buyer Consultation

All too often, the buyer consultation becomes a very one-sided conversation. Buyers relate their list of must-haves along with their budget. The agent, in turn, probes with a few basic questions:

- How many bedrooms/baths?

- Do you want a yard?

- What size garage will you need?

- How far are you willing to commute?

Once the details are drawn out, the agent heads to the MLS for a list of properties with matching criteria.

Now there’s nothing wrong per se with this standard approach. In fact, it works about 70% of the time. But if more than half of your buyers are walking away before finding a home, you may want to look closer at your consultation skills.

The Devil Is In The Details…

Improving your buyer consultation simply means getting more detailed. Clients, particularly first-time buyers, don’t always know what they want. Their home buying criteria may not be reasonable for the current market, for example. There may be alternatives they haven’t considered or aren’t aware of.

Buyers often turn to an agent even before they have adequately assessed their own resources or needs.

Quite often, there are many aspects of the transaction that they are not prepared for. They may be relying on misinformation or have unreasonable expectations that have never been addressed.

8 Typical Home Buyer Mistakes

- Overvaluation – paying more than a home is actually worth

- Home shopping without a mortgage or pre-approval letter

- Overlooking starter-homes for more expensive property

- Not considering a first-time buyer program

- Investing all their savings in a downpayment

- Overlooking flaws in a property

- Underestimating closing costs

- Miscalculating the cost of repairs/renovations

It’s your job as an agent to help your clients avoid costly mistakes. A more detailed home buyer consultation will not only save you time but will also save your clients money and frustration.

With a more detailed consultation, you’ll:

- Understand more clearly your client’s motivation

- Reduce the number of showings required

- Assess their knowledge of the market and homeownership

- Manage buyer expectations

- Advise them on cost-saving/financing solutions

- Find resources to address concerns

Home Buyer Trends

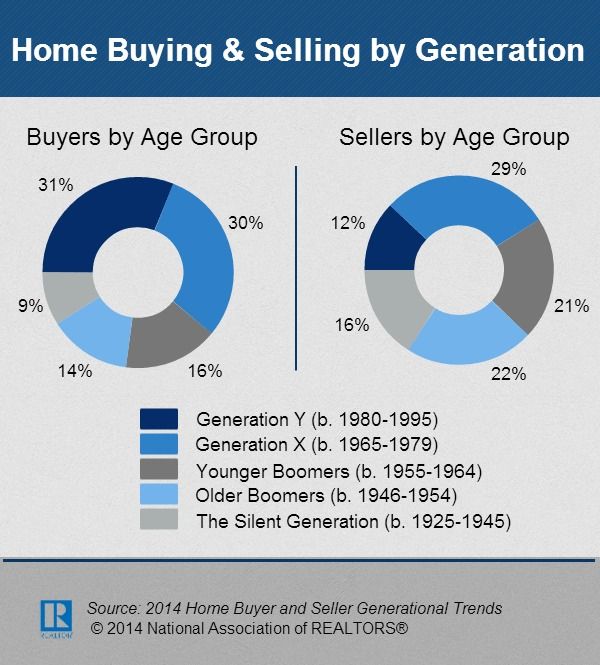

Buyers at different stages of life have different needs. A retiree has different criteria than a first-time millennial buyer. A single working mother will have different needs than a gay/lesbian couple or a traditional family household.

Generational and lifestyle trends have a huge impact on a buyer’s criteria. These should be considered very carefully when determining the right neighborhood or community for your prospects.

Price, of course, is another major factor impacting a buyer’s decision. If you are constantly showing buyers homes they can’t afford, don’t expect them to stick around for long.

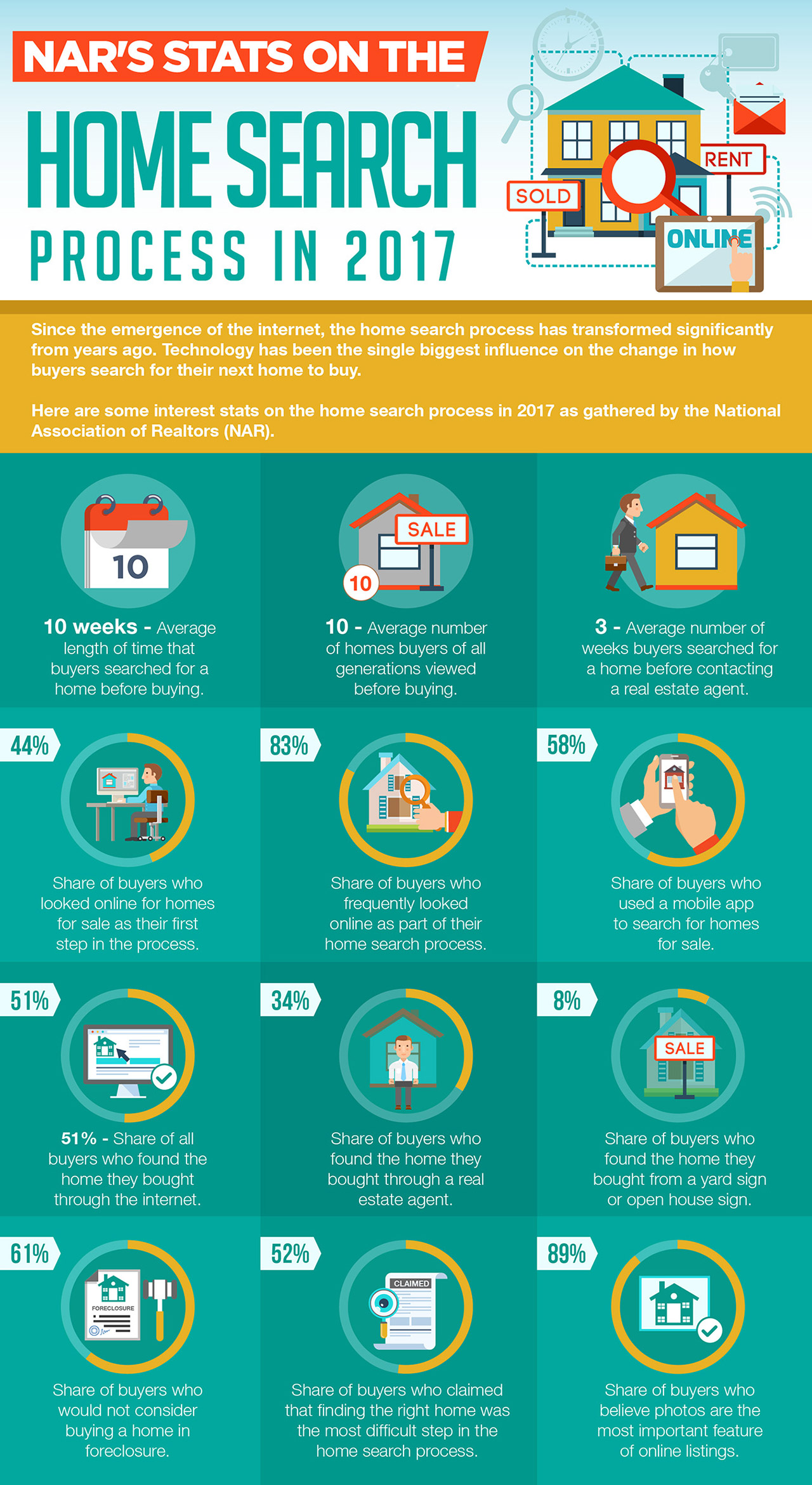

Consider these homebuyer statistics to help guide your next home buyer consultation:

Advising Today’s Home Buyer

Searching for a home in the 21st century is definitely not what it was twenty years ago. Buyers may be more informed, and they have more options, but they still need an agent.

It’s clear that agents still play a critical role in the home buying process, but technology has changed the way agents and buyers interact.

Your ability to leverage technology will go a long way in expediting the home buyer journey.

That being said, here are some practical tips to improve your home buyer consultation.

8 Home Buyer Consultation Tips

#1.) Become a neighborhood expert.

Knowing the market isn’t just about knowing the sale price of the most recent purchase on the block:

“Buyers spend an average of 6 to 8 weeks, according to the National Association of REALTORS, trying to figure out where they want to live.” (Source)

Neighborhood quality is just as important to buyers as price. Often, your clients are seeking a lifestyle as well as a property. They may be looking for:

- a neighborhood that is gay/ lesbian-friendly

- health-minded community with local amenities for staying active

- family-oriented with quality schools and affordable daycare

As a neighborhood specialist, you can provide buyers with insights into the kind of lifestyle they can expect with the purchase of their home. It’s also a good idea to partner with other neighborhood experts, like those found on Parkbench.

Connect with ver 1000 neighborhood specialists on Parkbench…

Connect with other neighborhood specialists and you’ll expand the options for your clients as well.

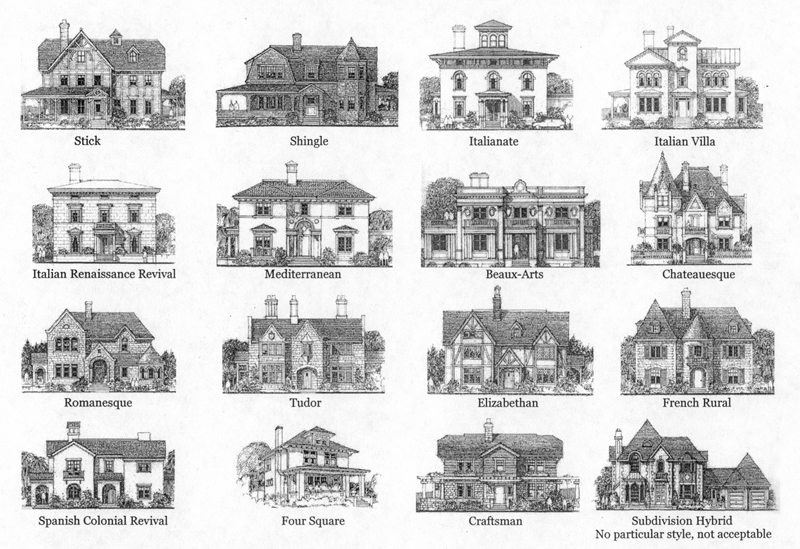

#2.) Familiarize yourself with the property types common in your neighborhood.

Detached single homes are always in demand, but they come in many styles: Ranch-style bungalow, Neo-Victorian, Cape Cod, Colonial, or Contemporary. How does a buyer choose?

Familiarize yourself with different architectural styles and their features. Provide buyers with visuals of different residential floor plans and layouts during your consultation. This can help them to narrow down more accurately the type of property that best suits their needs.

#3.) Visit open houses to see first-hand different layouts, floorings, and other features.

Make an effort to visit as many open houses as you can in your farm. Get to know the agents, the builders, and lenders involved. Take photos of your own to share with prospects by email or text.

Viewing homes on the market will give you a significant edge over competitors. Your first-hand knowledge will certainly impress clients. You’ll save them valuable time and avoid unnecessary showings.

#4.) Stay informed of technology trends that could offset or increase costs for your clients.

Smart home devices and energy-efficient appliances are a top priority for many home shoppers. Most buyers, however, are unaware or overestimate the impact technology can have on the value of their home.

A seller, for example, can charge an additional 3 – 5% for a smart-enabled home, but there may be monthly costs associated with its maintenance.

Your client may be adamant about buying a home with energy-efficient appliances, but it may be more cost-effective to purchase these after closing. First-time buyers, especially, can save money if they’re willing to do a little work on their own.

Stay informed of these trends so you can advise buyers on the best solution for their needs.

#5.) Perform a comprehensive market analysis (CMA).

In competitive markets with low inventory, bidding wars can get out of hand. In certain markets, foreign buyers will sometimes pay double for the right property! You need to recognize when it’s time to walk away from a potentially bad deal.

Seller agents, lenders, and homeowners will try to overhype the value of a property. That’s their job. Your job is to cut through the noise with sound data.

A comparative market analysis provides you and buyers with a more detailed view of the costs associated with their home. With sound market analysis, you can better manage client expectations. When buyers are prepared, they feel more confident and more decisive.

Factors To Consider in Your Comparative Market Analysis (CMA)

- Amenities

- Location

- Number of rooms

- Days on market

- Avg. selling price

- Sqr. footage

- Construction age

Refer to your local MLS regularly. NAR also provides market reports and research to give agents more insight into industry trends.

Use the insights gleaned from the MLS and NAR to provide clients with realistic projections. Share this information with your buyers during the consultation to manage their expectations.

Remember, clients who wind up overpaying for their home, ultimately blame the real estate agent. You won’t be able to cultivate referrals from past clients dealing with financial loss.

#6.) Determine your client’s buyer criteria in detail.

There’s nothing more annoying for buyers than being shown a property that doesn’t meet their criteria. The more detailed your buyer’s criteria, the easier it will be for you to find a home the first time.

Of course, buyers can change their requirements. They may not always be clear about what they want or need.

Help your clients list their needs along with their wants. Probe them for details with open-ended questions that force them to provide a thoughtful response.

Instead of merely asking:

- “Do you want a house with a big yard?”

Follow up with:

- “How often do you entertain guests at home currently?”

- “How much time do you spend gardening?”’

- “What experience do you have with yard maintenance?”

- “How much would you be willing to spend on landscaping/maintenance annually?”

Your consultation shouldn’t feel like the Spanish Inquisition. These questions, however, will get your client thinking more carefully about the realities of owning a large outdoor space.

To save time, create a questionnaire that your prospective buyer can complete prior to your consultation.

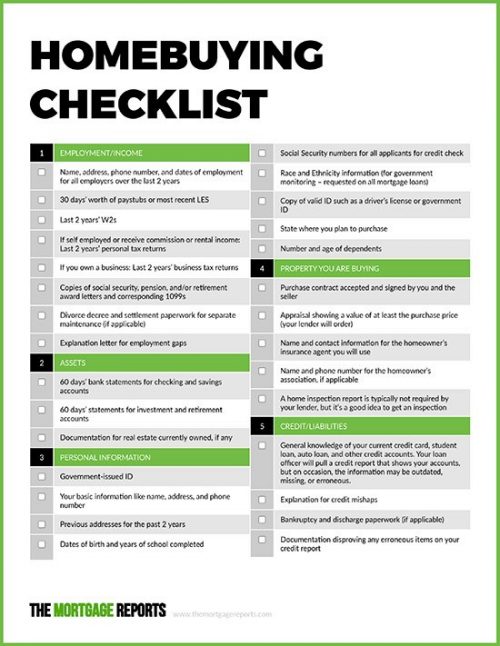

#7) Create a home buyer checklist.

One very practical way you can help your buyers is a checklist. Create the checklist and give it to them. Keep a copy for yourself and consult with your prospect regularly to ensure they are happy with the items on the checklist.

You can create the checklist as a simple Google Spreadsheet that can be shared on a common Google Drive. This way, either you or your prospect can access it from anywhere, anytime.

#8.) Don’t be afraid to challenge your client on their needs.

Quite often, buyers overlook the practical realities of homeownership. Your client may be impressed with a large yard, but if they don’t actually use it, maintaining it will become a chore.

An unkempt yard is unseemly and will certainly attract wildlife. A beautiful lawn requires attentiveness, care, and some interest in landscaping. Is your client prepared to invest in maintaining the yard? Do they have any experience?

Recommending a home with a smaller yard might save them money and be more suitable for their lifestyle. Alternatively, you could recommend a reliable landscaping service. Have them prepare a quote with annual projections on the cost of maintenance.

Go the extra mile and you’ll cultivate a stronger relationship that can yield referrals long after closing. Your clients will appreciate your insights if it means saving money or protecting their investment.

Conclusion

The home buyer consultation is a critical step in the home buyer’s journey. A comprehensive consultation can save your prospect valuable time and money.

During your consultation with prospects, be prepared with data, market research, and first-hand knowledge of the neighborhood. Use or create resources such as market reports, surveys, case studies, and infographics to help your clients understand more clearly the challenges they may face.

Finally, don’t overlook the details. Probe your client for more thoughtful answers when considering their list of criteria. Challenge them gently with detailed questions and provide them with alternative solutions.