Whether you’re a buyer or a seller agent, a comprehensive CMA plays a crucial role in any real estate transaction. Experienced agents know the impact an inaccurate CMA can have on negotiations, but newer agents need practice. Lots of it.

Overlooking important variables and drawing inadequate comparisons to the subject property are common rookie mistakes. This often accounts for the widely varying prices quoted by listing agents. Usually, the highest price wins the business, which is not always best for the client.

In this article, we’ll cover step-by-step how to prepare a comprehensive CMA of your own. With practice, you’ll become more confident and more accurate.

Let’s begin!

What Is A CMA?

After the initial home buyer consultation, you’ll want to follow up with a detailed CMA.

A comparative market analysis is an assessment of a property’s value, based on similar or comparable properties (comps) sold in the same market.

Independent appraisers, listing agents, mortgage lenders, and sellers conduct a CMA to determine the highest and lowest price point for a property.

Problems arise when inaccuracies exist in the CMA calculations. Many factors can impact a home’s final sold price. Property values can be impacted by geographic location, size, number of rooms, as well as the sold date.

Additional factors such as the financing history, previous foreclosures, and available inventory can also impact the sale price.

A CMA, however, is not the same as a home valuation. The home valuation determines the potential market value of a property based on its condition (ie location, style, structural issues, appeal, appliances, upgrades). It does not take into consideration external market factors.

On the other hand, a CMA compares the subject property to similar types and determines an appropriate market price, irrespective of the appraisal value.

For example, a 4 bedroom/5 bath, two-storey, detached home may be appraised at $1M, but a comparative market analysis could price the home for higher or lower, depending on market conditions.

If current demand is low, for instance, similar properties may be actively listed for under $1M. A CMA would include adjustments for current listings in the same subdivision, as well as those that have sold historically.

4 Tips Before You Start Your CMA

Location is a key factor when assessing property value…

#1) Stay local.

Compare properties in the same subdivision or as close to the area of your subject property as possible.

#2) Choose comparables carefully.

Compare apples to apples when possible. Make adjustments where necessary to compensate for extra rooms, baths, sq. footage, etc. If the subject property is a two-storey home and all you can find is a single-storey for comparison, deduct the appropriate square footage.

#3) Use the most current data.

Your CMA should include the most recent listings for a more accurate assessment. Volatile markets, in particular, can change drastically in 2 months. Properties sold in the final quarter can sell for much more than homes sold in the first quarter.

#4) Demand impacts property value.

Even matching properties in the same subdivision can sell for different prices depending on demand. Be sure to consider inventory levels as well when you prepare your CMA.

3-Part Guide To Preparing A Real Estate CMA

Welcome to our simple, 3-part CMA guide. Each section will cover the steps required to create your CMA using MLS Paragon and tax information from the CRS Suite.

Part 1: MLS Data

Step 1) Log in to your local MLS program

Step 2) Access Search button, Select ‘Residential’ class.

Step 3) Type in the address of your subject property.

Step 4) Search By Map.

Go to the Draw button tool.

Step 5) Draw a 0.5-mile radius around the subject property and ‘Add Criteria’ to your search.

Step 6) Select ‘Status’ and choose everything except ‘rented’ properties. Include active, expired, pending, and sold properties

Step 7) Select 2 date ranges. Go with 60 days, and a 6-month range to determine changes in demand.

Step 8) Go the residential-style field and select the appropriate one.

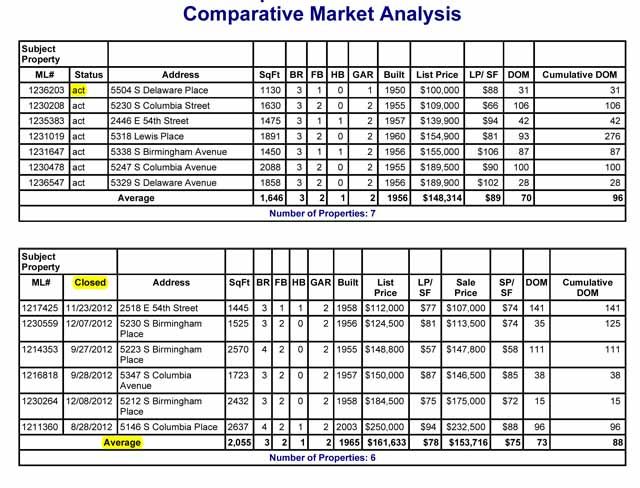

At this point, you should have a shortlist of all the properties in the area that have sold. You’ll also have a range of prices that give you an idea of market conditions, as well as inventory levels.

- Focus on construction types that match your subject property.

- Pay particular attention to the ‘Average days on market’ in your chosen subdivision. An increase suggests either low demand or a trend of overvaluation.

- You’ll also want to look at ‘Days on market’ for properties similar, as well as the number of active listings similar to your subject property.

If there are very few similar property types and high demand, the right price could spark a bidding war.

Conversely, high inventory might require you to lower your listing price or lowball sellers with your offer. They may take the bait if similar homes in their area take longer to sell, saving your buyers money.

Part 2: Drawing Comparables

With a snapshot of the local market conditions, your CMA is partially complete. Now you’ll need to draw comparables that match your subject property as closely as possible.

You’ll want to select 2 – 3 properties sold within 90 days. Some of the search parameters you’ll need to use are:

- Age

- Subdivision

- zoning

- taxes

- Construction Type

- Amenities

- Square Footage

Follow the steps below for your comparables:

Step 1) Access the CRS data from your MLS dashboard.

Step 2) SEARCH the subject property address to view all the tax information associated with the subject property.

Step 3) Go to the ‘Comparables Tab’.

Step 4) Go to the Map View

Select a radius of no more than 0.5 – 0.75 miles.

You can now refine your comparables even further by using the Search Parameters field:

Step 5) Select 2 – 3 of the most recently sold properties that are the closest in proximity to your subject property. Eliminate exceptionally high or low prices in the range. These may be the result of either low or high inventory at the time.

Step 6) Examine the CRS data for each property. Take note of the Price/Sq. Foot column.

Pay attention to foreclosures as well as the financing history on the properties you select, which can significantly impact property value.

Part 3: Calculating Property Value By Square Footage

Using the price/sq. foot, you can now calculate the potential value of your subject property:

FOOTAGE X PRICE (per Sq. Ft.) = SELLING PRICE

So, for example, if the sq. footage is $3500 and your square footage is 200, your listing price is:

$3500 x $200 = $700,000

- Now, go back to your MLS Data and refine your search parameters by sq. footage.

- View all the ACTIVE properties with matching square footage.

- Adjust your comparables based on square footage. If a comparable is 250 sq. foot, and your subject is only 200 sq. ft, calculate the value of your property based on cost per sq. foot.

- Compare your subject property to the larger property, and you should have a value relatively close to the current listing price. If not, view the CRS details to determine what factors may have impacted the listing price.

- Print your CMA as a branded document you can give to your client.

- Take a hint from TwentyNewClients on how to create a CMA that stands out:

Conclusion

Learning to read CRS data and interpret it will take practice. The more you practice, the easier it becomes to analyze.

If you’re new to real estate or just trying to improve your CMA skills, seek out more experienced agents or brokers to guide you whenever possible.